The Form 5500 Series is an important compliance, research, and disclosure tool for the Department of Labor, a disclosure document for plan participants and beneficiaries, and a source of information and data for use by other Federal agencies, Congress, and the private sector in assessing employee benefit, tax, and economic trends and policies. Mouse craft 1 2011. Principal Life Insurance Company: DFE: Pooled Separate Account: $134,718,116: Prin Intl Emerg Markets Sa-Z: Principal Life Insurance Company: DFE: Pooled Separate Account: $120,478,731: Principal Select Stable Sa: Principal Life Insurance Company: DFE: Master Trust Investment Account: $107,536,991: Prin Core Plus Bond Sep Acct-Z: Principal Life.

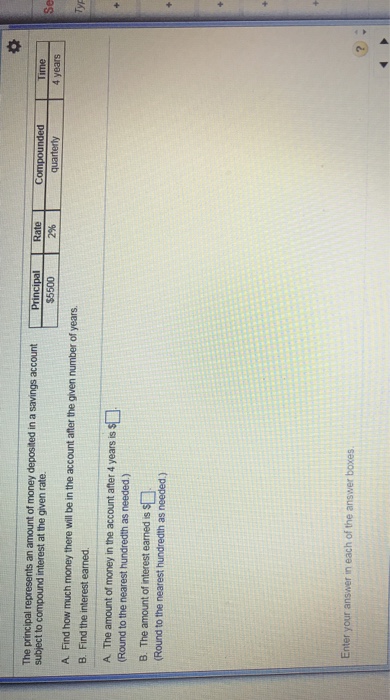

The future value calculator can be used to calculate the future value (FV) of an investment with given inputs of compounding periods (N), interest/yield rate (I/Y), starting amount, and periodic deposit/annuity payment per period (PMT).

Principal 5500

ResultsFuture Value: $3,108.93

|

Schedule

| start principal | start balance | interest | end balance | end principal | |

| 1 | $1,000.00 | $1,000.00 | $60.00 | $1,160.00 | $1,100.00 |

| 2 | $1,100.00 | $1,160.00 | $69.60 | $1,329.60 | $1,200.00 |

| 3 | $1,200.00 | $1,329.60 | $79.78 | $1,509.38 | $1,300.00 |

| 4 | $1,300.00 | $1,509.38 | $90.56 | $1,699.94 | $1,400.00 |

| 5 | $1,400.00 | $1,699.94 | $102.00 | $1,901.93 | $1,500.00 |

| 6 | $1,500.00 | $1,901.93 | $114.12 | $2,116.05 | $1,600.00 |

| 7 | $1,600.00 | $2,116.05 | $126.96 | $2,343.01 | $1,700.00 |

| 8 | $1,700.00 | $2,343.01 | $140.58 | $2,583.59 | $1,800.00 |

| 9 | $1,800.00 | $2,583.59 | $155.02 | $2,838.61 | $1,900.00 |

| 10 | $1,900.00 | $2,838.61 | $170.32 | $3,108.93 | $2,000.00 |

RelatedInvestment Calculator | Present Value Calculator

Principal Form 5500

Future Value

The future value calculator can be used to determine future value, or FV, in financing. Snapndrag pro 4 2 2. FV is simply what money is expected to be worth in the future. Typically, cash in a savings account or a hold in a bond purchase earns compound interest and so has a different value in the future.

A good example for this kind of calculation is a savings account because the future value of it tells how much will be in the account at a given point in the future. It is possible to use the calculator to learn this concept. Input $10 (PV) at 6% (I/Y) for 1 year (N). We can ignore PMT for simplicity's sake. Pressing calculate will result in a FV of $10.60. This means that $10 in a savings account today will be worth $10.60 one year later. Soulver 3 2 2 1 download free.

Principal Form 5500

The Time Value of Money

FV (along with PV, I/Y, N, and PMT) is an important element in the time value of money, which forms the backbone of finance. There can be no such things as mortgages, auto loans, or credit cards without FV.

To learn more about or do calculations on present value instead, feel free to pop on over to our Present Value Calculator. For a brief, educational introduction to finance and the time value of money, please visit our Finance Calculator.